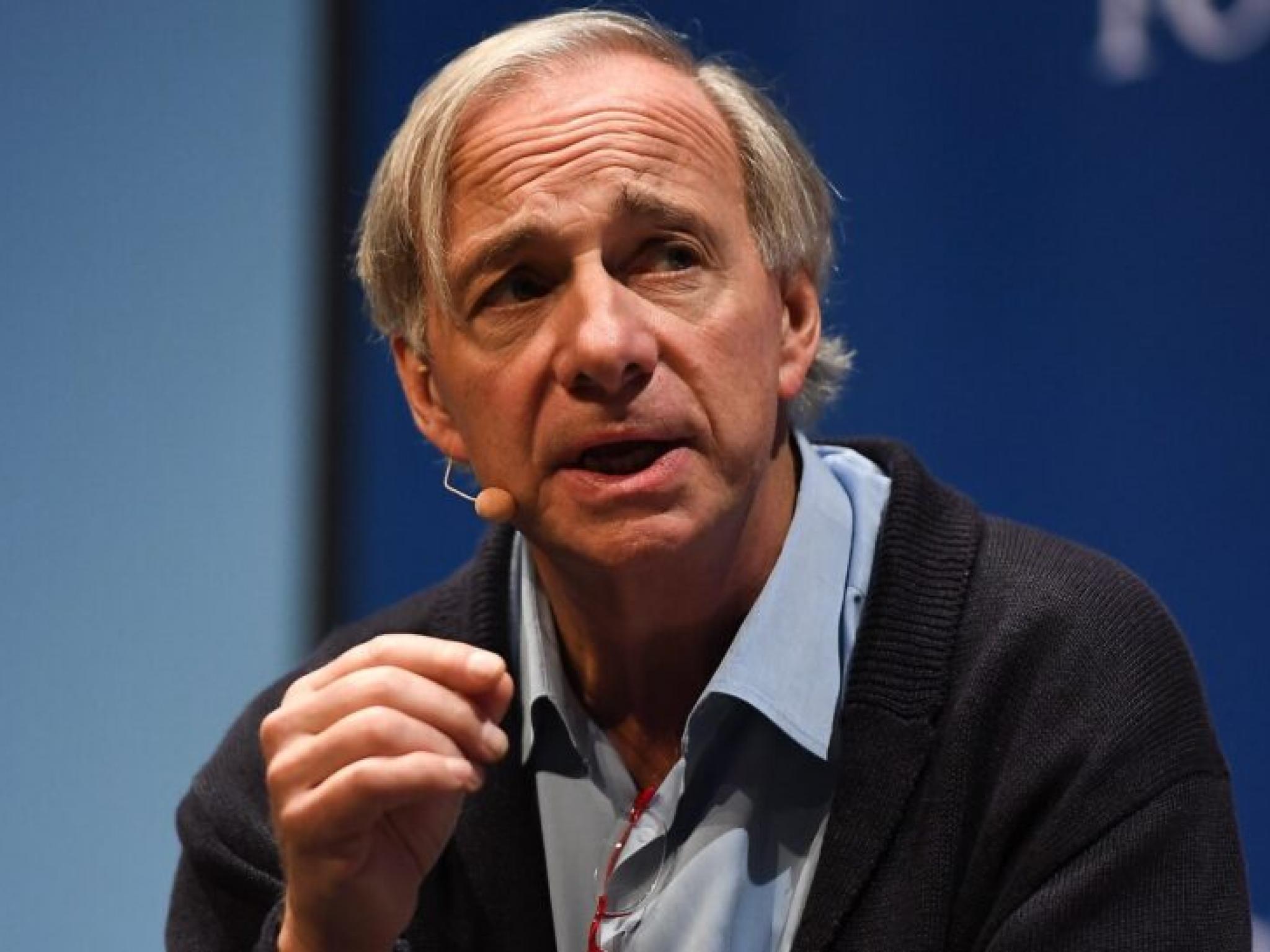

Ray Dalio, founder of Bridgewater Associates, expressed concerns about a potential recession despite President Donald Trump pausing reciprocal tariffs.

What Happened: According to a report by Fortune, Dalio shared his views on Bloomberg Television on Thursday, following Trump’s announcement of a 90-day grace period for trade negotiations.

Trump’s decision to halt reciprocal tariffs did not alleviate worries, as he imposed a 10% blanket tax on other nations and duties on China.

Dalio highlighted the likelihood of a recession, defined as two consecutive quarters of negative GDP growth, but emphasized broader concerns about financial, political, and geopolitical dynamics.

As tensions between the U.S. and China escalate, with Trump imposing a 145% tariff and China retaliating with a 125% tariff, the trade war has intensified.

Moody’s Chief Economist, Mark Zandi, told Fortune that U.S.-China trade could nearly halt, increasing recession risks.

Dalio noted the ongoing bond market sell-off is a consequence of Trump’s tariffs, as investors abandon bonds and stocks.

Analysts from Bank of America suggested the bond market turmoil prompted Trump’s tariff pause, particularly concerning the 10-year Treasury. Despite some stock market relief, bond market distress persists, with a slowdown appearing more probable than a recession.

Why It Matters: The concerns raised by Ray Dalio come in the wake of his previous warnings about the economic impact of escalating tariffs.

Earlier, Dalio praised Trump’s decision to pause tariffs, except on China, calling it a “better way” to handle trade imbalances. He urged a U.S.-China trade deal and deficit reduction, suggesting that China could appreciate the renminbi against the U.S. dollar by selling dollar assets and easing fiscal policies.

Dalio has also cautioned about “abrupt, unconventional changes” in markets due to the “tariff machine,” which affects currency, monetary, and fiscal policies. He emphasized that while the first-order effects of tariffs are visible, the second-order effects could lead to significant market volatility.

In a broader context, Dalio has warned of a looming debt crisis and a shifting global order amid Trump’s hardline trade policies. He has expressed concerns about the potential for a debt crisis and the implications of changing global political dynamics.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock