Block, Inc. XYZ shares are soaring in overnight trading on Sunday ahead of the S&P 500 debut of the Jack Dorsey-founded fintech company.

What happened: Block was up 8.31% as of this writing on the Robinhood trading platform.

The company's inclusion in the coveted S&P 500 index, seen as the barometer of the U.S. stock market, will become effective July 23, according to a press release shared Friday.

See Also: Tom Lee Says Michael Saylor-Led Strategy’s 35x Surge Wasn’t Just Bitcoin — Treasury Moves ‘Far More Significant’ Than Token Price Gain

Why It Matters: Block, formerly known as Square, was founded in 2009 and specializes in point-of-sale systems and payment solutions. It gradually expanded its portfolio, placing a special focus on cryptocurrencies, particularly Bitcoin BTC/USD.

Today, its offerings include the ‘Bitcoin-only’ Cash App digital wallet service, the self-custody Bitcoin wallet Bitkey, the Bitcoin mining product suite Proto and the Bluetooth-powered messaging service Bitchat.

The firm announced a new strategy, effective April 2024, wherein it would allocate 10% of its monthly Bitcoin-related gross profit to purchase additional Bitcoins. It holds a total of 8,584 BTC, worth over $1 billion, as of this writing, according to Bitcoin Treasuries.

Price Action: Shares of Block closed 2.95% higher at $72.82 during Friday’s regular trading session. The stock has risen 81% over the last month. According to data from Benzinga Pro. Year-to-date, the coin has lost over 14%.

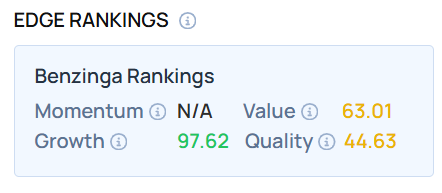

The stock exhibited a very high growth score—a measure of the stock’s combined historical expansion in earnings and revenue across multiple periods. How does it compare with Coinbase Global Inc. COIN and other cryptocurrency-related stocks? Visit Benzinga Edge Stock Rankings and find out.

Read Next:

Photo by Frederic Legrand – COMEO on Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.