Citigroup Inc. C CEO Jane Fraser revealed the company’s intention to issue a stablecoin on Tuesday as part of the banking giant’s broader dive into digitization.

What Happened: During Citi’s second-quarter earnings call, Fraser deemed stablecoins as the “next evolution” in the digitization of payments, and said the company is looking to issue a Citi stablecoin in the future

Fraser detailed four core areas of exploration for the bank regarding stablecoins, including reserve management, cash and coin on and off-ramps, tokenized deposit space and custodial solutions for crypto assets.

Fraser called the tokenized deposit space the most important, an area where she said Citi is “very active.”

See Also: Stablecoin Issuers Just Got A New Income Stream—And It’s Built Into The Blockchain

Why It Matters: This announcement comes at a time when major banks are intending to integrate dollar-pegged stablecoins with their operations.

Jamie Dimon, CEO of the world’s largest bank JPMorgan Chase & Co. JPM, said big banks are lagging in the stablecoin race and need to embrace them as a way to keep pace with payment rivals.

Citigroup has been proactive in its digital strategy. In 2023, the bank launched Citi Token Services, a service centered around smart contracts aimed at revolutionizing instant payments.

The bank reported its second-quarter financials, with revenue and profit beating expectations, largely driven by its interconnected businesses.

Price Action: Citi shares rose 0.09% in after-hours trading after closing 3.68% higher at $90.72 during Tuesday’s regular trading session.

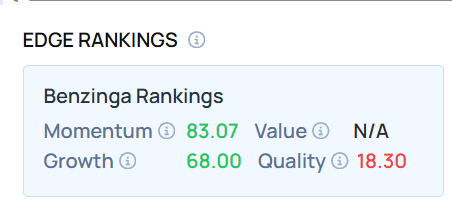

The stock recorded a high momentum score as of this writing. Use Benzinga Edge Stock Rankings to see how it compares to JPMorgan and other major banking firms.

Photo Courtesy: Konektus Photo on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.