Cryptocurrency behemoth Coinbase Global Inc. COIN is seeking the SEC’s approval to offer “tokenized equities” to its customers, according to a report on Tuesday.

What Happened: Paul Grewal, the chief legal officer of Coinbase, said in a Reuters interview that the concept is a “huge priority” for the company. However, he did not disclose whether an official request had been submitted to the SEC or when a potential product launch might occur.

“With a no action letter, an issuer of a tokenized equity or a platform that wishes to offer secondary trading in those equities can have some confidence, some comfort, that the SEC has adopted its view of why this product is compliant,” Grewal said.

The SEC didn’t immediately return Benzinga’s request for comment.

See Also: If You Invested $100 In Shiba Inu When The Coin Launched, Here’s How Much You’d Have Now

This move by Coinbase comes in the wake of similar efforts by other companies. Last month, Robinhood Markets Inc. HOOD proposed a federal framework to the SEC for tokenized real-world assets.

Currently, tokenized equities are not available for trading in the U.S., but firms are experimenting with the concept. Rival cryptocurrency exchange Kraken announced last month that it is launching tokens of U.S. equities, called xStocks, via Solana SOL/USD, which will be available in select markets outside the U.S.

Price Action: Shares of Coinbase fell 0.35% in after-hours trading after closing 2.95% lower at $253.85 during Tursday’s regular trading session, according to data from Benzinga Pro.

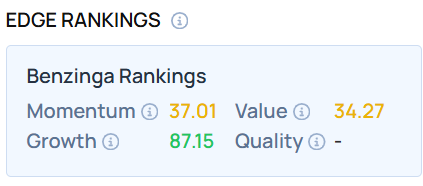

As of this writing, COIN ranked high on growth, an indicator of a stock’s combined historical expansion in earnings and revenue across multiple periods. But does it perform better than Robinhood stock? Visit Benzinga Edge Stock Rankings to find out.

Read Next:

Photo Courtesy: Mehaniq On Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.