Strategy Inc. MSTR, a stock popularized as a proxy for Bitcoin BTC/USD, received mixed signals from key technical indicators Thursday.

What happened: According to the market analytics platform TradingView, the simple and exponential moving averages across and above the 30-day timeframe produced a “Buy” signal for the stock.

A moving average calculates the average price of a financial instrument over a specific period. If the price is above the moving average, the trend is upward. If the price is below the moving average, the trend is downward. Traders use moving averages to identify entry and exit points.

Moreover, the Bull Bear Power indicator, which measures the strength of buyers and sellers, also signaled “Buy.”

See Also: Forget Dollars: Willy Woo Says Bitcoin Will Be Priced Against Global GDP — ‘Gold Used To Be That Money, BTC Is The Challenger’

InvestXOS, an investment-focused X account, said MSTR was building "serious momentum" with a potential cup and handle formation on the daily chart.

"If it somehow runs past $400 psychological level, we might see a huge, huge b/o," the analyst said, projecting potential price targets at $541, $566 and $582.

The momentum indicators, however, painted a different story. The Moving Average Convergence Divergence indicator, which plots the relationship between two moving averages—typically a 12-day and a 26-day exponential moving average—flashed "Sell" for MSTR.

Meanwhile, the Relative Strength Index indicator used for spotting overbought or oversold conditions showed a ‘Neutral’ reading for the stock.

On the derivative front, MSTR's Put/Call Ratio was 0.85 as of this writing, according to Fintel, indicating that bullish bets outnumbered bearish bets.

Why It Matters: Strategy has been at the forefront of Bitcoin's corporate adoption, holding a BTC stockpile worth more than $60.8 billion as of this writing, according to bitcointreasuries.net.

The stock has seen significant volatility in the last eight months or so. Strategy’s corporate strategy of using debt and equity to accumulate Bitcoin makes it highly sensitive to the apex cryptocurrency’s price swings.

Price Action: At the time of writing, BTC was exchanging hands at $104,905.99, up 0.88% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy were up 0.41% in pre-market trading after closing 2.41% lower at $378.10 during Wednesday's regular trading session.

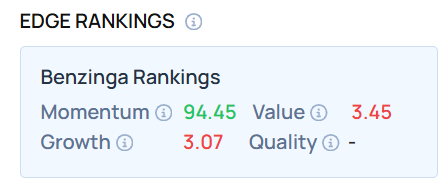

MSTR demonstrated a very high momentum score—a measure of the stock's relative strength based on its price movement patterns and volatility over multiple timeframes—as of this writing. Want to see which stocks outperformed MSTR in this metric? Visit Benzinga Edge Stock Rankings.

Read Next:

Photo courtesy: PJ McDonnell / Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.