Tyler Winklevoss, co-founder of cryptocurrency exchange Gemini, accused banking giant JPMorgan Chase & Co. JPM and its CEO Jamie Dimon on Sunday of attempting to stifle fintech and cryptocurrency companies in the U.S. by charging fees for customer data access.

What Happened: In an X post, Winklevoss criticized JPMorgan’s recent move to charge fees for accessing their customers’ bank-related information via third-party data aggregators, such as Plaid and MX.

The rule, according to him, could bankrupt the firms that help link bank accounts to cryptocurrency companies, such as Gemini and Coinbase Global Inc. COIN.

“This is the kind of egregious regulatory capture that kills innovation, hurts the American consumer, and is bad for America,” he said.

Winklevoss also cited Section 1033 of the Consumer Financial Protection Act that requires financial institutions to make account-related data available to consumers and their authorized third parties without charging fees.

He said that by enforcing the controversial rule, Dimon and his associates were undermining President Donald Trump’s vision to make America a hub of innovation and the “crypto capital of the world.”

JPMorgan didn’t immediately return Benzinga’s request for comment.

Why It Matters: Winklevoss’s criticism echoed that of other cryptocurrency industry executives. Arjun Sethi, co-CEO of cryptocurrency exchange Kraken, described JPMorgan's plan as a "calculated move" to assert ownership over consumer data

Moreover, White House cryptocurrency advisor David Sacks called the development “concerning” while pro-cryptocurrency Senator Cynthia Lummis (R-Wyo.) reposted Winklevoss’s post.

Notably, Dimon has been a vocal critic of Bitcoin BTC/USD, but indicated previously that JPMorgan is planning to get more involved with stablecoins, cryptocurrencies pegged to the dollar.

Price Action: Shares of JPMorgan were up 0.17% in after-hours trading after closing 0.10% lower at $290.97 during Monday’s regular trading session, according to data from Benzinga Pro.

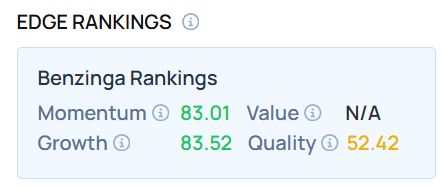

JPM ranked high on the Momentum and Growth metrics as of this writing. For similar information on other big banking stocks, check out the Benzinga Edge Stock Rankings.

Read Next:

Photo Courtesy: lev radin on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.