Tom Lee, head of research at Fundstrat Global Advisors, predicts that Strategy Inc. MSTR (formerly MicroStrategy) could deliver superior returns compared to Bitcoin BTC/USD itself as the cryptocurrency rallies.

What Happened: “As Bitcoin goes up, MicroStrategy very likely goes up a lot more,” Lee said in a Wealthion interview reposted on X.

MicroStrategy transformed from a software company into one of the world’s largest corporate Bitcoin holders through an aggressive debt-fueled acquisition strategy. The company now holds 592,100 Bitcoin worth approximately $60 billion, generating an unrealized gain of 43% according to recent filings.

Lee explained the company’s innovative financing approach allows it to issue convertible bonds at “almost no interest cost” to purchase additional Bitcoin. This strategy has created a premium valuation mechanism where MicroStrategy trades based on its Bitcoin holdings rather than its legacy software business performance.

The Tyson Corner-based company recently completed a $1 billion Bitcoin purchase funded through its new Stride preferred stock offering, bringing its total cryptocurrency treasury near 600,000 coins. Executive Chairman Michael Saylor targets raising $84 billion through 2027 under the company’s “42/42” plan for continued Bitcoin acquisitions.

Why It Matters: TD Cowen analysts rate the securities “very safe,” noting MicroStrategy holds $63 billion in underlying Bitcoin value against $11.6 billion in total debt plus preferred stock. The firm maintains a “buy” rating with a $590 price target on MSTR shares.

Lee previously projected Bitcoin could reach $250,000 by end-2025, citing supply scarcity with 95% of coins already mined while 95% of the world doesn’t own Bitcoin.

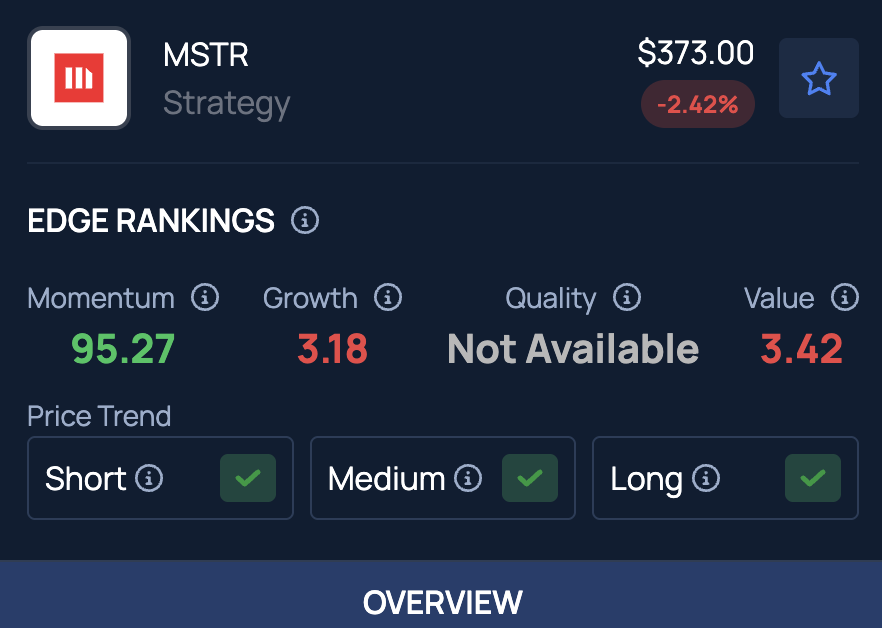

Price Action: Bitcoin currently trades at $106,582, up 1.67% in 24 hours, with a market capitalization exceeding $2.1 trillion. MicroStrategy shares closed at $377.02, gaining 2.68% Tuesday and advancing 25.67% year-to-date.

MSTR currently shows a very high momentum score, reflecting strong price action and volatility across multiple timeframes. Explore Benzinga Edge Stock Rankings to find similar high-momentum stocks for your portfolio.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Mamun_Sheikh / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.