MicroStrategy Inc. MSTR, operating under the Strategy brand, has expanded its Bitcoin BTC/USD treasury to 592,100 BTC following a $1 billion purchase funded primarily through its new Stride preferred stock (STRD) offering.

What Happened: The corporate Bitcoin treasury company completed the acquisition last week using proceeds from its upsized $1 billion perpetual preferred stock issuance, reported The Block.

TD Cowen analysts said the STRD offerings will “prove highly accretive” to MSTR shareholders and “establishes a channel for future high yield funds flows into Bitcoin,” the report noted.

Strategy’s latest preferred instrument offers a fixed 10% non-cumulative annual dividend and ranks below the company’s senior preferred shares but above common equity, according to the report. The STRD product joins Strategy’s existing preferred offerings: convertible STRK with an 8% dividend and non-convertible STRF with a 10% cumulative dividend.

See Also: Salesforce Raises Enterprise Software Prices 6% As Company Pushes AI-Powered Agentforce Platform

Why It Matters: TD Cowen analysts consider the securities “very safe,” noting Strategy holds $63 billion in underlying Bitcoin value against $11.6 billion in total debt plus preferred stock outstanding, according to the report. The firm maintains a “buy” rating with a $590 price target on MSTR shares.

Chairman Michael Saylor targets a long-term leverage ratio of 20% to 30% through fixed income securities as part of the company’s “42/42” plan to raise $84 billion through 2027 for Bitcoin acquisitions.

The preferred stock strategy capitalizes on what Saylor described to the Financial Times as a “quadratically reflexive, engineered instrument” that allows Strategy to issue shares at premiums to Bitcoin’s value, effectively acquiring BTC at discounts.

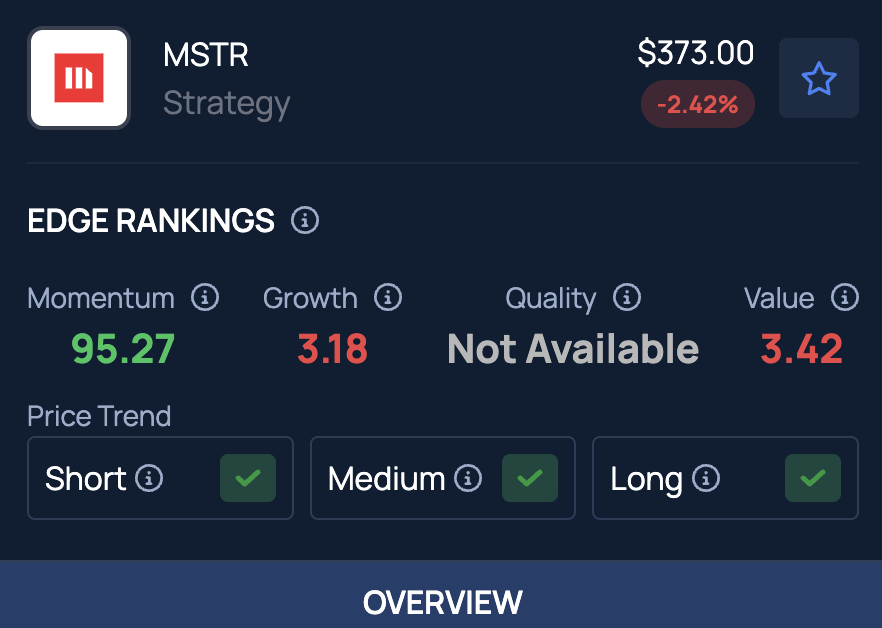

Price Action: MSTR stock closed at $375.18 on Tuesday, down 1.85% for the day. In pre-market trading, the stock edged up 0.14% to $375.71. Year to date, MSTR shares have gained 25.06%.

MSTR shows strong momentum based on price movement and volatility. See where it ranks among the top 20 momentum stocks on Benzinga Edge Stock Rankings.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Mamun_Sheikh / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.